Spyro Kemble, a 30-year real estate veteran and four-decade resident of the Port Streets in Newport Beach, has seen many changes in the market. As president of the Newport Beach Association of Realtors, he acknowledges that 2017 continues to look good for real estate in the coastal region. His own star is ascending, too, featured in a Bravo realty TV show about million dollar listings scheduled for broadcast this summer.

Q: How did Newport Beach weather the recession?

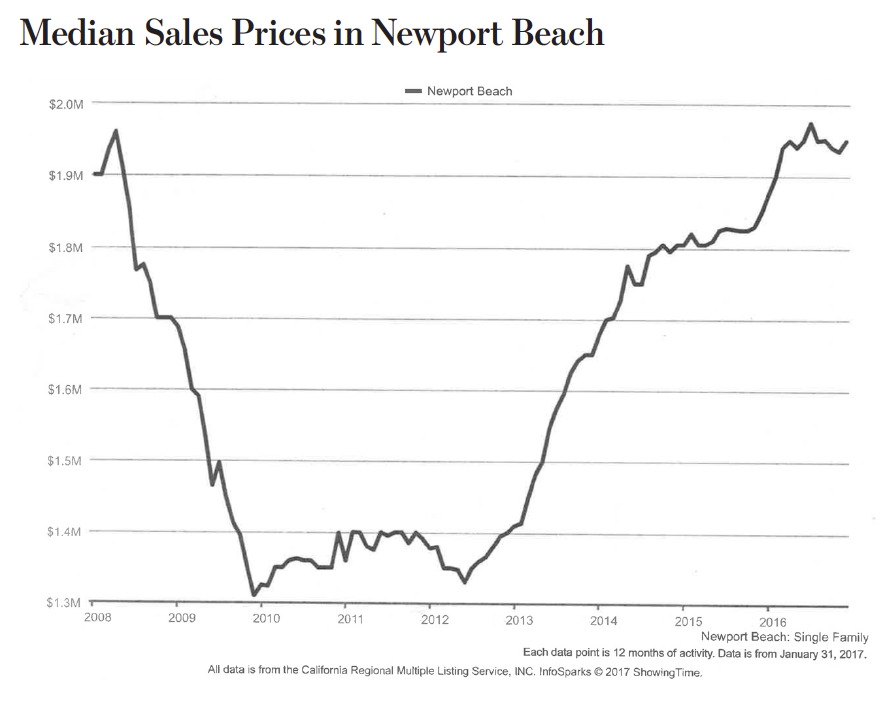

A: Newport Beach is a destination for resort living and always in demand. The city’s available pool of buyers did not shrink like the rest of country. Prices obviously dropped during the recession, but have for the most part rebounded since then.

Q: What percentage of luxury homes make up Newport Beach?

A: Luxury homes found in Newport Beach are the same as in Riverside. It’s a very subjective term. When asked, you’ll find it encompasses a price tag of $6.7 million and above. If we are talking about homes that are more custom, such as homes found in Newport Coast, Crystal Cove, Irvine Terrace, Cameo Shores, Three Arch Bay, Emerald Bay and CdM’s Shorecliff as well as properties on the bay and peninsula, we really exceed that price tag.

Q: NAR announced a drop in home sales in January.

A: We have dropped in that market, but still see on average a 6% annual appreciation, which in my opinion is still enough for a seller to sell and a buyer to have confidence in the market. Buying during the bubble from 2004 to 2007 saw an 18% appreciation, but no market can sustain that type of increase. Eventually you just run out of buyers. Lenders are doing their due diligence in contributing to a healthy market. Underwriting loans are still very stringent. They are not lending to those who want to afford, but those who can.

Q: Do you see a lot of cash buyers?

A: We average 20 to 30% of cash buyers for coastal markets. When the market was heating up last summer, what kept it from boiling over is that appraisers kept the market down with stricter assessments and kept it in check. We don’t want a recurrence from previous years when the market heated up too fast. Right now it is a neutral market – not a buyer’s or a seller’s market. Both buyers and sellers have to make compromises in order to close a deal.

Q: How affordable is Newport Beach?

A: Newport Beach is the most expensive area to live in Southern California. Only 23% of median households can afford to live here, which means 77% cannot. There are a very small percentage of first time home buyers that can afford to find a home here. Typically, the entry type of home for a single family is approximately $1.5 million. You might be able to find some in this area under 2000 square foot that is a non-view property. About 3 – 5% of buyers are from the international market, mainly Russians, Middle Easterners and Asians, the biggest sector.

Q: According to your graph, median prices in Newport increased after a drop last quarter. What factors caused the jump?

A: It always goes down the last quarter. Last year there was the uncertainty of who would win the election that made hesitation in the high-end market. Now with a new administration in office, a lot of pent up demand is now manifesting. Especially with the market as bullish as it is, people feel more confident and willing to buy.

Q: Do you see indicators of a slowdown?

A: Real estate always corrects itself from the bottom up. The healthier the bottom market indicates a healthier upper market. Take a look at the real estate under $1 million, it is as good as it has ever been. There are multiple offers from properties that immediately are listed. People learn very quickly they have to be more aggressive on their quotes. A good property lists at about $750,000 – $1 million. People are now over-bidding that amount. It just shows how the demand for properties under a million has taken off and inventory is now low. Homes over $1.5 million and over is obviously not selling at the same pace.

Q: So prices are going up?

A: They are moving up again, but responsibly. Again, lenders are making sure the buyers have the means to payback the loan. This time around, the underwriting is very thorough. This is reflected in the distressed market where only 2.5% is distressed (anything lender owned or short-sales) and 97.5% is all equity sales, a big turn-around from four or five years ago. There are no distress properties in Newport Beach or Newport Coast.

Q: Why do you think 2016 was the fastest-selling year for housing since 2006?

A: We are almost back to 2006 prices and high demand. It took 10 years to rebuild all the equity that was lost in the housing crises and get to this point again. I just came back from a meeting in the desert where they talked about the rise in consumer confidence and how the real estate market will continue to become healthier. The economists in California say the market will continue to improve until 2019 and this is great news.

CONTACT INFORMATION

Spyro Kemble

Sureterre Properties

1400 Newport Center Drive, Suite 100

Newport Beach, CA 92660

949.689.8377

www.SpyroKemble.com

By Gina Dostler