It’s hard to appraise properties in Laguna Beach. I know because I used to be an appraiser during the mid ‘80s and ‘90s, with coastal properties, and Laguna Beach in particular, as one of my areas of specialty. Back then, the appraisal industry was like the wild West as it was before state certification existed.

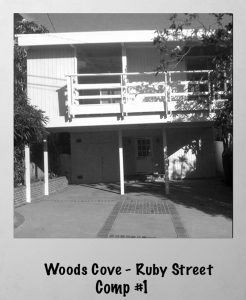

The documentation appraisers presented was hand written on 5×7 index card complemented by a polaroid photo of the subject and comps. While the process has vastly changed, the uniqueness of the homes in Laguna Beach have not, which continues to make identifying comparable properties (aka: comps) a puzzle that requires a unique skill set. Adding to the conundrum of the matchless architecture, varying effective age and vastly different views, appraisers also often face the challenge of accounting for the “elephant in the room,”which is the unpermitted additions that must be addressed.

Having crossed over to the realtor side of the industry, and now with years of wearing both hats, I have grown to become vigilant in looking out for all the nuances and consequences in the appraisal process. For example, a converted garage that is being used as an office will not get the same “appraised value” as living space. In fact, an appraiser may deduct value assigning a “cost to cure” to bring it back to a usable garage, per code. This can open a whole can of worms that requires working with the city to properly retrofit the property, engaging architects, contractors, engineers, etc.…., which boils down to time, money and potentially jeopardizing a transaction in play.

Here’s the thing. While a converted garage can add value because it’s useful space, when it comes to selling an unpermitted property it may come back and bite you. All that said, there’s a way to “present” properties on paper to a lender that explain the market in a sensible and tangible manner without raising red flags. The approach the appraiser should take is to identify similar properties that also have converted garages, permitted or not, which indicate market support for the special use. All this points to the importance of engaging seasoned real estate professionals who can help with the lending side of the transaction.

Although the appraisal is just one part of the home buying process, it can be a big deal as it is a contingency on the California residential purchase agreement. If the appraisal doesn’t support the agreed upon purchase price, the sales price could potentially be renegotiated, and if that doesn’t work, the buyer has to come up with more cash down, or the escrow is cancelled entirely. This makes for a very unhappy buyer and seller, driving home the fact that appraisal process is less of a science and more of an art!

By Kelly Perkins

By Kelly Perkins

Kelly Perkins is a realtor, recently joining Villa Real Estate to work in association with John Stanaland. She lives in Laguna Beach and can be reached at kperkins@villarealestate.com.